In late 2022, Google declared a "Code Red" in response to the launch of ChatGPT. It was a moment of rare vulnerability for the search giant, signaling that a nimble startup had caught the incumbent napping. Less than two years later, the tables have turned with poetic, if brutal, symmetry. Now, it is OpenAI CEO Sam Altman declaring a "Code Red," pausing ambitious expansions to frantically shore up the company's core product.

This reversal is not merely a story about corporate anxiety; it is a textbook case study in the brutality of commoditized technology markets and the enduring power of distribution moats.

The Retreat to the Core

According to internal memos, OpenAI is delaying several high-profile initiatives—including advertising integrations, health agents, and its personal assistant project, Pulse—to refocus entirely on ChatGPT’s speed, reliability, and reasoning capabilities. While this is publicly framed as a strategic prioritization, industry signals suggest a more troubling reality.

There are persistent whispers across the AI sector that OpenAI has faced significant hurdles in its recent pre-training runs. Users have noted that even the most advanced iterations of ChatGPT claim a knowledge cutoff of June 2024, a stagnation that suggests the company may be hitting diminishing returns or technical roadblocks that were absent in the GPT-3 and GPT-4 eras. If the frontier of model capability has stalled, OpenAI loses its primary differentiator: magic.

The Netscape Moment: Bundling vs. Standalone

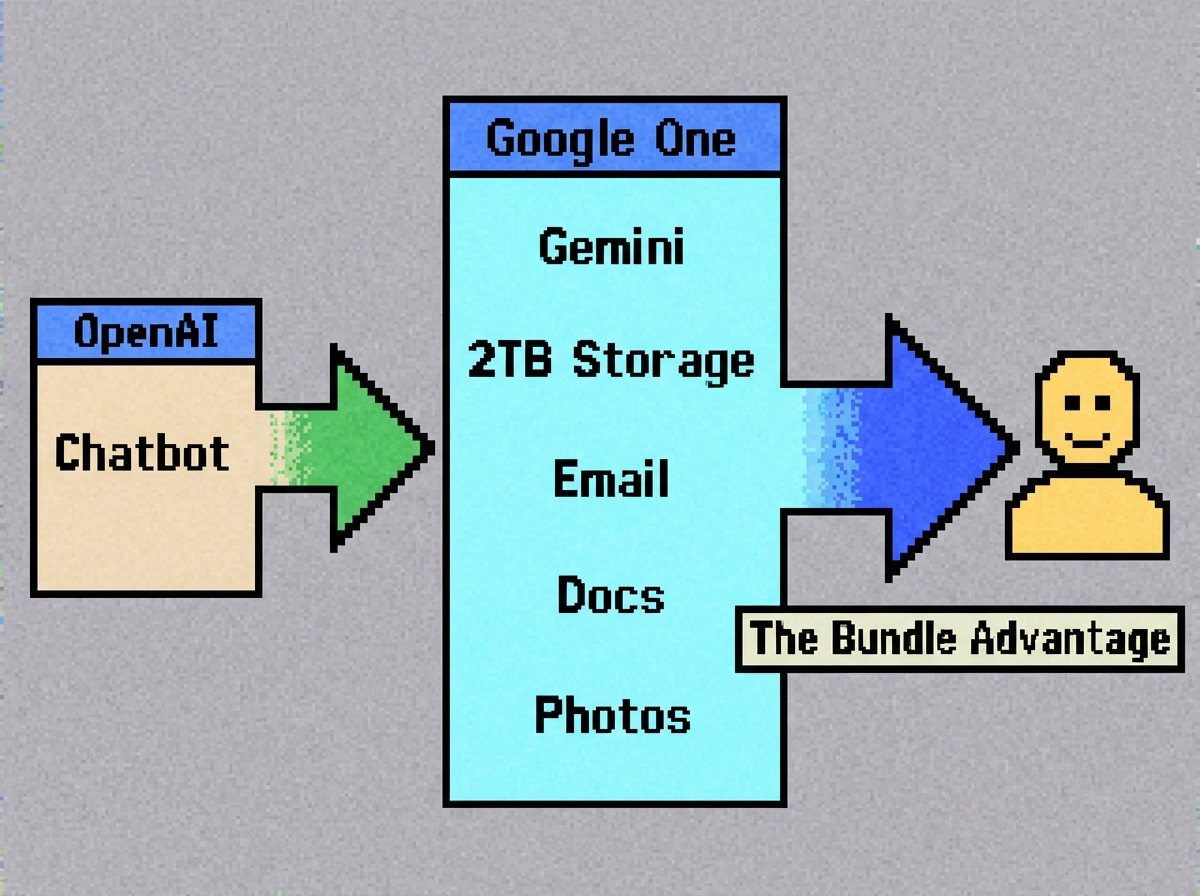

OpenAI is rapidly approaching its "Netscape moment." Like the early browser pioneer, OpenAI introduced a revolutionary product that defined a generation of the internet. However, Netscape was eventually crushed not by a superior product, but by Microsoft's ability to bundle Internet Explorer with the operating system.

Google is currently executing a similar playbook with ruthless efficiency. While OpenAI struggles to justify a $20/month subscription solely for a chatbot, Google is rolling out Gemini 3 bundled with 2TB of storage, Workspace integration, and Android capabilities. For the average consumer, the value proposition of a standalone AI subscription evaporates when a "good enough" (or superior) model is included in the services they already pay for.

Furthermore, Google’s infrastructure advantage is beginning to tell. Reports indicate that Gemini 3 is not only performing better on benchmarks but is also seeing rapid adoption due to superior multilingual support and integration with tools like NotebookLM. OpenAI has the brand, but Google has the ecosystem.

Management Panic and "The Mythical Man-Month"

The internal response to this crisis at OpenAI—daily update calls and temporary team transfers to boost velocity—raises red flags for anyone familiar with software engineering history. These tactics are reminiscent of the errors described in Fred Brooks' seminal work, The Mythical Man-Month.

Throwing more bodies at a late software project generally makes it later, and instituting daily micromanagement often signals that leadership has lost faith in its mid-level management. This type of "Code Red" environment rarely produces breakthrough innovation; instead, it tends to burn out the individual contributors who are already wading through technical debt. It suggests an organization shifting from offensive innovation to defensive panic.

The Financial House of Cards

Perhaps the most existential threat to OpenAI is not Google’s code, but its own balance sheet. The company has lined up over $500 billion in long-term infrastructure commitments, including the massive "Stargate" data center project and billions in GPU purchases. These commitments are predicated on a future of explosive revenue growth.

If OpenAI falls behind technologically or cannot generate sufficient revenue to service these massive commitments, the fallout will not be contained within the company. Partners like Oracle, which has financed billions in infrastructure based on OpenAI’s projected growth, could face massive liabilities. The systemic risk here is significant; a stumble by OpenAI isn't just a startup failure—it’s a potential shockwave for the energy grid, the semiconductor supply chain, and the cloud computing market.

Conclusion: The Moat That Wasn't There

The prevailing narrative has been that OpenAI possessed a technological moat—a secret sauce that would keep it years ahead of the competition. That moat appears to have been a mirage. Without a major breakthrough that fundamentally separates GPT-5 from Gemini or Anthropic’s Claude, the industry is racing toward a bottom where intelligence is a commodity.

Google, with its infinite capital, proprietary data (YouTube, Search), and distribution network, was always the inevitable final boss in this game. OpenAI woke the giant, and now the giant is awake, angry, and bundling its way to victory.